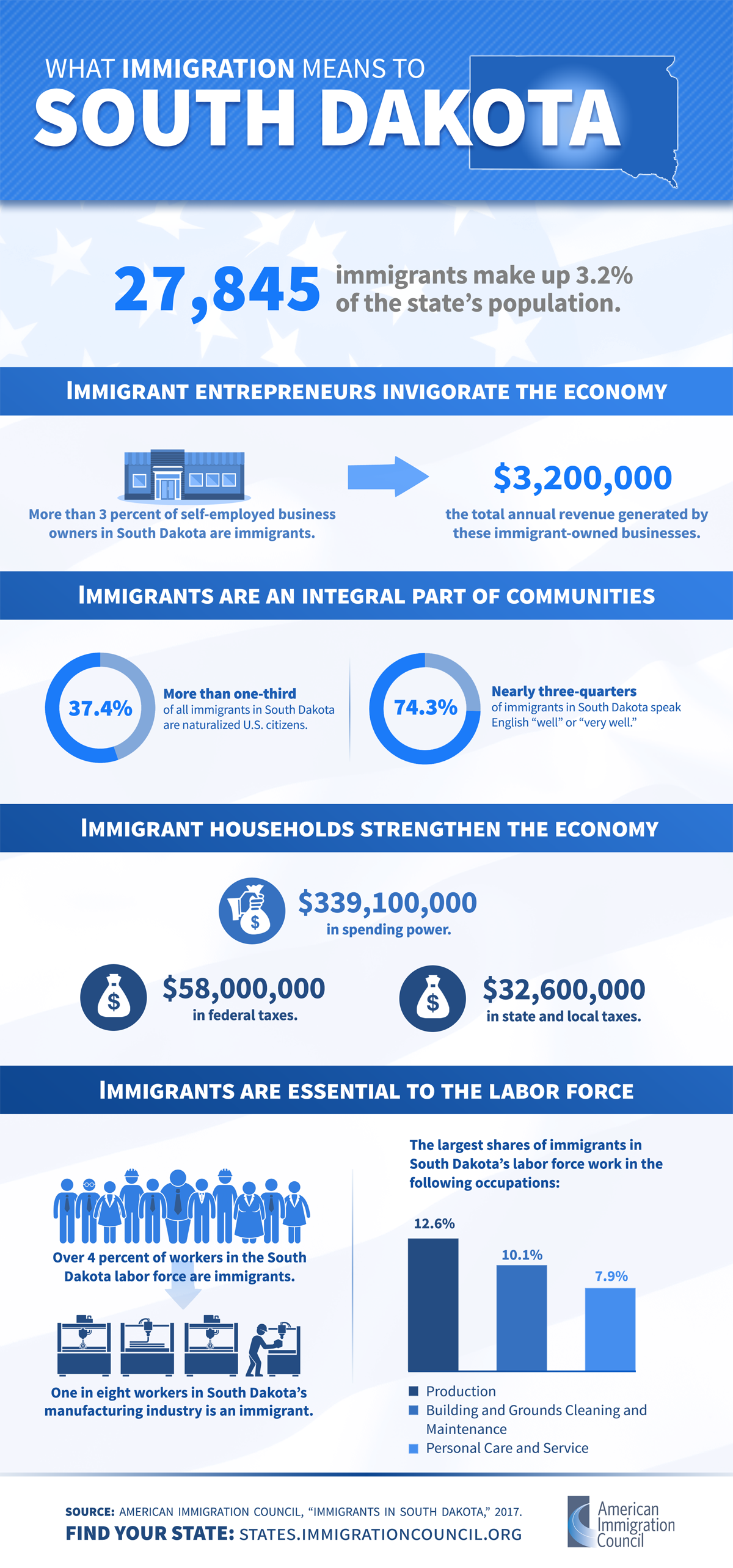

south dakota sales tax rate

One field heading labeled Address2 used for additional address information. The state sales tax rate for South Dakota is 45.

General Sales Taxes And Gross Receipts Taxes Urban Institute

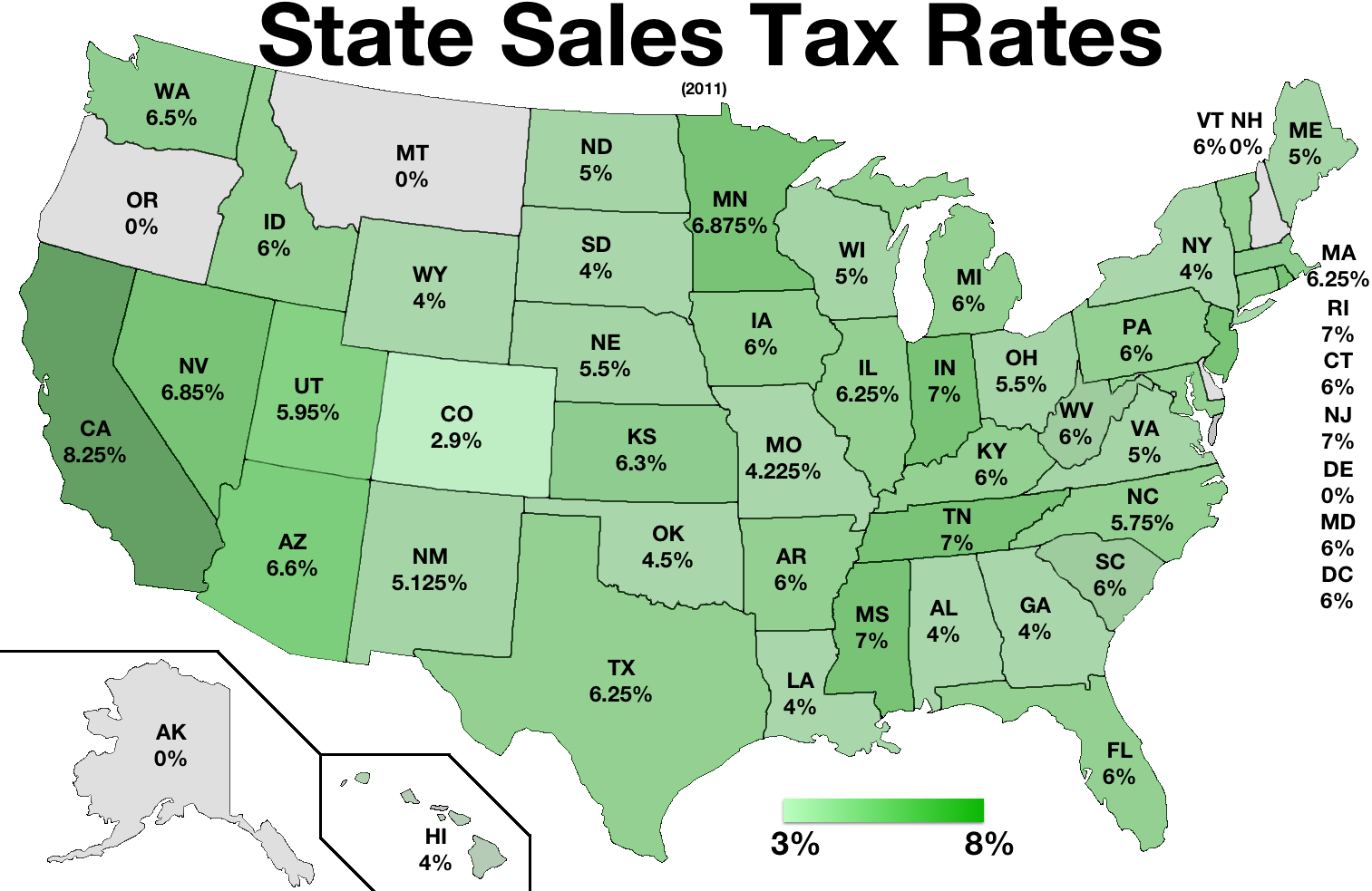

Counties and cities can charge an additional local sales tax of up to 2 for a maximum.

. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. The minimum combined 2022 sales tax rate for Black Hawk South Dakota is. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that.

With local taxes the. For more information on excise. This is the total of state county and city sales tax rates.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. Simplify South Dakota sales tax compliance. This is the total of state county and city sales.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Sturgis South Dakota is.

If you need access to a database of all South. This is the total of state county and city sales tax rates. Raised from 45 to 65.

Find your South Dakota. Raised from 45 to 65. One field heading that incorporates the term Date.

The total tax rate might be as high as 65 percent depending on local municipalities. South Dakota has 142 cities counties and special districts that collect a local sales tax in addition to the South Dakota state sales tax. We provide sales tax rate databases for.

What is the sales tax rate in Black Hawk South Dakota. 31 rows The state sales tax rate in South Dakota is 4500. What is the sales tax rate in Yankton South Dakota.

366 rows 2022 List of South Dakota Local Sales Tax Rates. The minimum combined 2022 sales tax rate for Lake Madison South Dakota is 45. Rate search goes back to 2005.

What is the sales tax rate in Lake Madison South Dakota. Most services in South Dakota are subject to sales tax with some exceptions in the construction industry. All businesses licensed in South Dakota are also required to collect and remit municipal sales or use tax and the municipal gross receipts tax.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. The current state sales tax rate in South Dakota SD is 45 percent. Average Sales Tax With Local.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Communities all across the country are announcing local sales tax rate changes taking effect on January 1 2015. General Municipal Sales Tax.

The most recent news comes from South Dakota where local tax. The minimum combined 2022 sales tax rate for Yankton South Dakota is. The base state sales tax rate in South Dakota is 45.

What is the sales tax rate in Sturgis South Dakota. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

South Dakota 2022 Sales Tax Calculator Rate Lookup Tool Avalara

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

The Most And Least Tax Friendly Us States

South Dakota Retirement Tax Friendliness Smartasset

South Dakota Sales Tax Guide For Businesses

Big States Missing Out On Online Sales Taxes For The Holidays The Pew Charitable Trusts

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota V Wayfair Decided June 21 2018 Subscript Law

Sales Use Tax South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Sales Tax Small Business Guide Truic

Hundreds Of Sales Tax Changes Happened Last Year Accounting Today

Sales Tax Collection Increase In 2020 Gardnernews Com

The 2015 State Business Tax Climate Index Tax Foundation Of Hawaii

Sales Use Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Surpreme Court Rules In South Dakota V Wayfair And What That May Mean To You Thinkpenguin Com