GST payment

Goods Services Tax GST Payments. GSTHST payment and filing deadlines Payment deadline Filing deadline Example.

This one-time GST credit payment will be double the amount of the GST credit you would receive over a six-month period.

. The tax credit only applies to. If your business income is reasonably consistent throughout the year you might prefer to pay a GST instalment amount option 3 in your business activity statement. The GST credit program comes in the form of quarterly payments.

Monthly if your GST turnover is 20 million or more. Canadians eligible for the GST rebate can expect to receive an additional lump sum. GSTHST Payment Dates for 2022.

This is an amount we. Your GST payment is due on the same day as your GST return. Payments can be received through direct.

Tax Tip - Six month doubling of GST credit payment starts November 4 2022. 201 Ottawa unveils 45B affordability plan including dental care GST credit Millions of Canadians woke up Friday morning with hundreds of dollars from Canadas federal. 3 months after fiscal year-end.

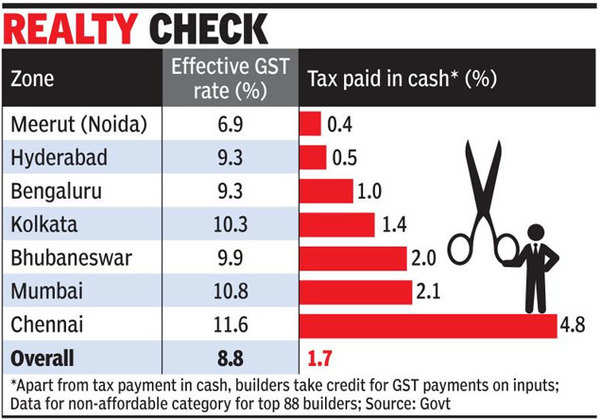

Quarterly if your GST turnover is less than 20 million. The payment dates for GST and HST this year are. As per GST payment rules if you are supplying or providing any goods or services to your customer and charging or receiving tax like GST.

If you do not receive your GSTHST credit. A sign outside the Canada Revenue Agency is seen in Ottawa Monday May 10 2021. 3 months after fiscal year-end.

OTTAWA ON Nov. Pay domestic GST Use this account number if youre paying any amount due on your GST return to Revenue Jersey Quote your GST registration number as your reference Bank. If you are already entitled to receive the GST credit in October of this year you will automatically qualify for the one-time GST payment top up.

For the 2021 base year payment. Tax refunds made via cheques. GST Payment Dates in 2022.

Then you are required to pay that. The amount is calculated based on your family situation in October. For example the taxable period ending 31 May is due 28 June.

Note that July 2022 to June 2023 payment will be the start of a new calendar year for GST payments and it will be based on your 2021 tax returns. Goods Services Tax GST Login. Your GST reporting and payment cycle will be one of the following.

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. Therefore those who apply and qualify can receive four special payments from the Canadian government each. Goods and Services Tax.

This is the 28th of the month after the end of your taxable period. 4 2022 CNW Telbec - The first of the Government of Canadas new. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the.

You can claim a GST refund if your customer has not paid you within six months of the sale Completing your GST return A step-by-step guide to completing your GST return online. End of reporting period. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April.

Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the date of the tax credit arises.

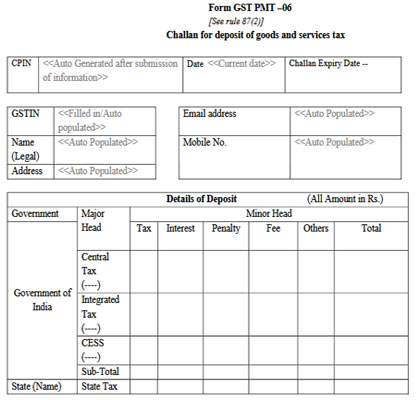

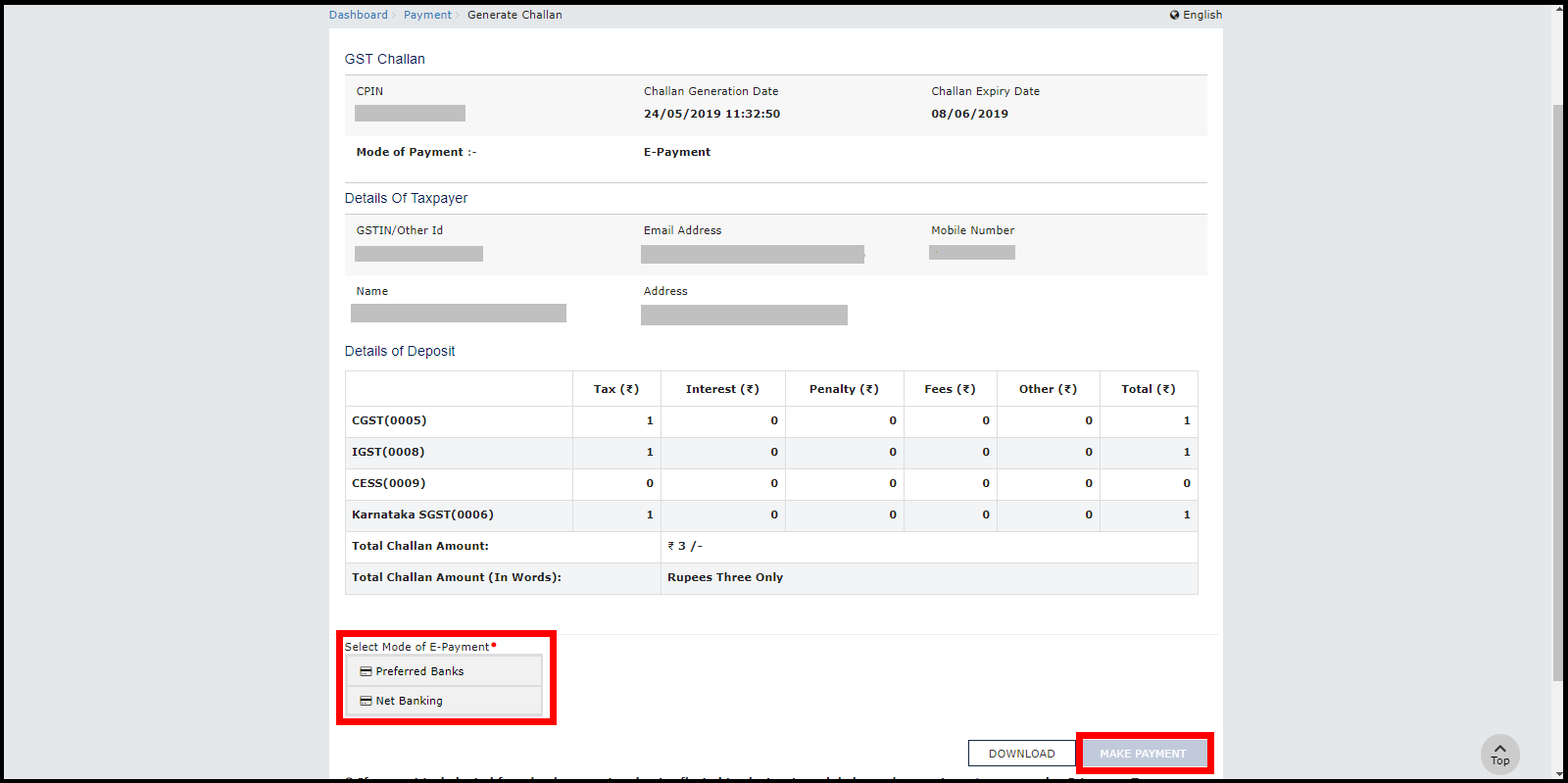

Gst Challan Payment With Pdf Format And Download Process

How To Create Gst Payment Challan In Portal Baba Tax

How To Deal With Late Payments Under Gst

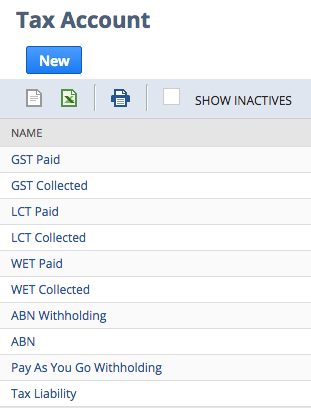

Bas Payment Of Gst Payg Jcurve Solutions

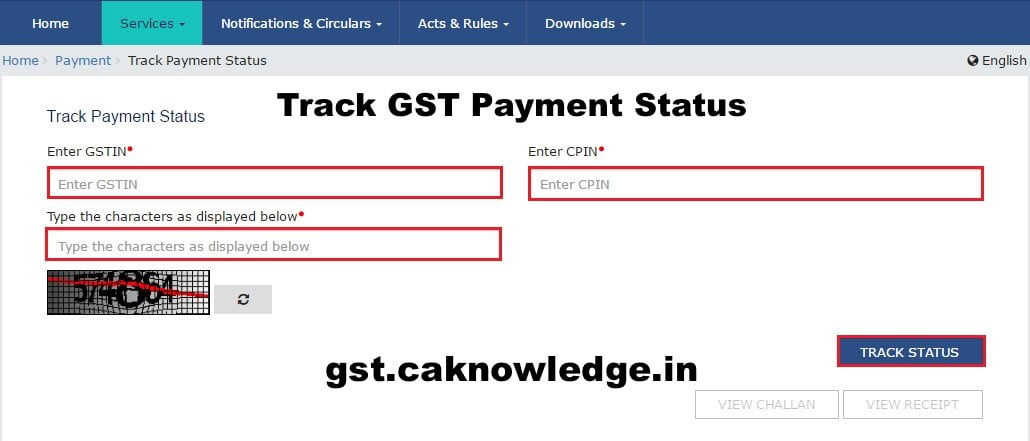

Track Gst Payment Status How To Check Status Of Gst Payment

![]()

Audit Exemption Gst Paid Save Icon Download On Iconfinder

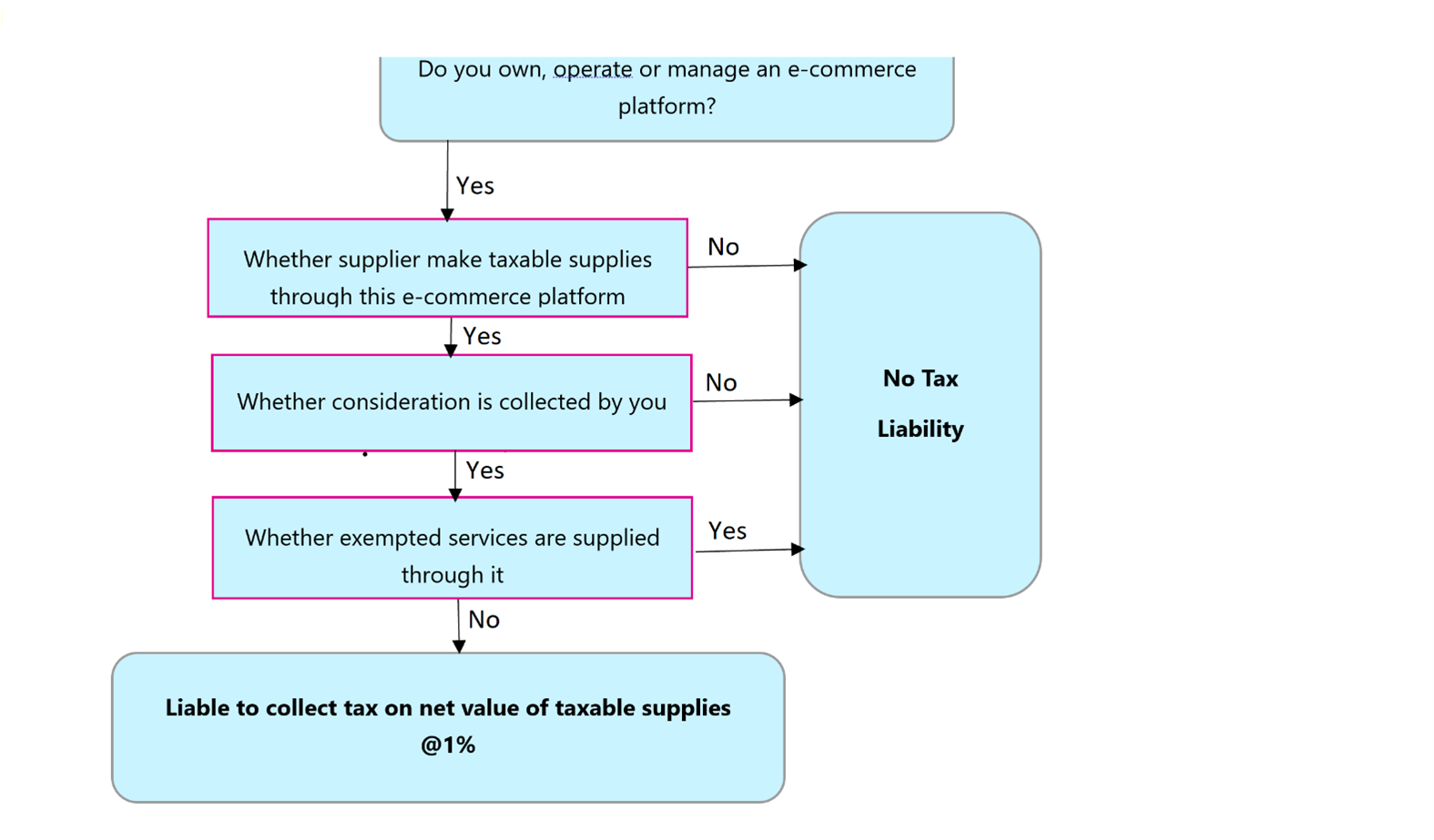

Gst Tcs On Payment Of Goods And Services Finance Dynamics 365 Microsoft Learn

Gst Payment Challan Gst Pmt 06 Masters India

Steps For Gst Payment Challan Through Gst Portal

Frequently Asked Questions On Gst Payment Process Enterslice

How To Make Payment In Gst Portal Youtube

Working Out Your Gst Return Gst Bas Guide Xero Au

What Are The Different Gst Payment Modes

Gst Tcs On Payment Of Goods And Services Finance Dynamics 365 Microsoft Learn

How To Link Gst Payment By Neft Or Rtgs To Gst Challan Youtube